How Much Does a Food Trailer Cost? Complete 2025 Price Guide for USA

Is the founder of ‘Sabor sobre Ruedas’, a successful food trailer specializing in Latin American fusion cuisine. With a passion for culinary innovation,

The straightforward answer: A typical food trailer costs between $10,000–$50,000 for used models and $40,000 $100,000+ for new builds. However, your total startup investment including equipment, permits, insurance, and branding typically ranges from $50,000 to $200,000 depending on location, trailer size, and operational scope.

I know what you’re thinking: “That’s a massive range. How do I actually know what to expect?” Here’s the uncomfortable truth that most guides won’t tell you straight up: the cost of your food trailer represents only the beginning. The real financial weight comes later permits that spike in Boston to $17,066 annually, hidden repairs on used units that cost $4,000–$12,000, and the compliance nightmare of NSF certification if your equipment doesn’t match local codes. But there’s a clear path forward. In this guide, I’ll show you exactly what drives these costs, how to evaluate new versus used options, and the specific financial framework that separates profitable food truck owners from those who run out of capital before their first year ends.

Quick Price Overview: Food Trailer Costs at a Glance

The baseline pricing breaks down distinctly by trailer condition and intended operation. These are the ranges you’ll encounter in today’s market:

New Food Trailers: $40,000–$100,000+

Standard 16–20ft models with NSF-approved kitchen equipment come fully equipped with warranties covering 1–3 years on appliances. You’re paying a premium for compliance assurance and operational reliability from day one.

Used Food Trailers: $10,000–$60,000

Significant savings exist here, but require professional inspection and potential refurbishment costs of $2,000–$10,000 depending on equipment condition and structural integrity.

DIY/Custom Built Trailers: $20,000–$65,000

The most economical path for niche concepts, yet demands technical skill or contractor markup for critical systems like electrical, propane, and plumbing installations.

New Food Trailers: What You’re Paying For

The price escalation from $40,000 to $100,000+ reflects tangible factors that impact your operational success and profitability timeline. Let’s decode what each tier provides.

Entry-Level Models ($40,000–$60,000)

These compact 16ft trailers form the backbone of the budget-conscious market. Equipment packages include griddles, fryers, and refrigeration units all NSF-compliant and warranty-backed for 1–3 years on appliances. What you sacrifice here is workflow efficiency and menu versatility. Limited counter space and cooking stations restrict your ability to scale production during peak hours. This tier works for single-item focused concepts (coffee, donuts, tacos, or hot dogs) where predictable demand keeps complexity low.

Golden State Trailers, a major national fabricator, begins their new builds at around $50,000, with pricing scaling based on size and customization needs.

Mid-Range Models ($60,000–$100,000)

This sweet spot balances versatility with reasonable investment. You’re upgrading to 18–24ft trailers with enhanced kitchen workflow, premium cooking appliances like convection ovens and multi-burner gas ranges, and integrated POS-ready systems. Advanced ventilation systems such as EconAir exhaust hoods rated for 400,000+ BTU output—meet even stringent municipal codes without retrofit costs. This tier attracts established operators expanding their concept or entrepreneurs confident in their menu’s market fit.

Premium/Custom Builds ($100,000+)

Fully customized 24–30ft trailers with specialized equipment (rotisserie systems, wood-fired ovens, custom grills) command these prices. You’re investing in differentiation high-end stainless steel finishes, professional branding aesthetics, and dual cooking zones that allow simultaneous preparation of distinct menu items. These builds target high-volume catering operations, multiple-location chains, or niche concepts (like specialty pizza or BBQ) where equipment uniqueness becomes a competitive moat.

Used Food Trailers: When They Make Sense

Buying used flips the financial equation you absorb depreciation risk in exchange for capital preservation. The market’s wide pricing reflects actual condition variance, not just marketing spin.

Price Variance by Age and Condition

Models from 2015–2018 represent the sweet spot: $25,000–$45,000 for trailers with documented service history and recent compliance inspections. This window balances modern equipment standards with real depreciation. Pre-2015 models plummet to $10,000–$25,000, offering maximum savings but introducing repair risk older propane systems, outdated refrigeration efficiency, and potential corrosion inside walls.

Like-new recent models (2020+) command $40,000–$60,000, eliminating depreciation advantage but providing warranty coverage closer to new purchases.

What to Inspect Before Buying Used

Professional inspection is non-negotiable. Examine equipment functionality against documented service history faulty griddle thermostats or failing compressors signal upcoming replacement costs. Structural integrity demands visual inspection underneath: look for rust on the frame (especially suspension points), dents indicating past collisions, and water stains indicating roof leaks or plumbing failures. Electrical and propane systems must carry current certification. Health department compliance documentation proves the trailer passed recent inspections critical because previous health violations become a red flag indicating systemic design flaws that inspection cannot fix.

Refurbishment Costs You Should Budget

Paint and graphics wrap: $3,000–$5,000 to rebrand the exterior and hide cosmetic wear

Equipment repairs/replacements: $2,000–$10,000 depending on how many appliances fail inspection

Re-certification and permits: $500–$2,000 for local compliance updates

This cumulative refurbishment can consume 30–40% of your purchase price, narrowing the advantage over a new build, especially if unexpected structural repairs emerge during operation.

Equipment Costs: The Real Investment Inside

Your $50,000+ investment breaks down into specific components. Understanding this structure helps you identify where to invest for your specific concept versus where you can cut costs responsibly.

Core Cooking Equipment ($8,000–$20,000)

This category dominates your equipment budget:

- Griddles/flat tops (36-inch): $2,000–$6,000. The workhorse of burger, breakfast, and fry operations.

- Deep fryers: $1,500–$4,000. Essential for wings, fries, and fried chicken concepts.

- Convection ovens: $2,500–$6,000. Higher-end models support baking, roasting, and meal variety.

- Gas ranges with multiple burners: $1,500–$3,000 for commercial-grade models.

Budget-conscious concepts (hot dog carts, taco stands) can operate on $5,000–$8,000 of cooking equipment. Multi-station concepts targeting $1,500+ daily revenue require the full $15,000–$20,000 investment.

Refrigeration & Storage ($2,000–$8,000)

- Reach-in refrigerators/freezers (27.5-inch units): $1,500–$3,500

- Under-counter storage units: $500–$1,500 per unit

- Stainless steel shelving systems: $200–$500 per unit

Starter concepts can launch with a single reach-in unit ($1,500) plus basic shelving. Full-service trailers require multiple refrigeration zones (prep, ingredient storage, finished goods holding) totaling $5,000–$8,000.

Plumbing & Utility Systems ($3,000–$7,000)

- Water tanks (fresh water 37–40 gallon capacity, gray water 90+ gallon): Foundation cost around $800–$1,500

- Hot water heater (10-gallon on-demand systems): $1,000–$2,000

- Three-compartment sink + hand washing station: $1,000–$2,000

- Waste management system: $400–$1,000

These systems are non-negotiable per health codes. You cannot cut corners here—non-compliant plumbing systems result in failed inspections and permit revocation.

Ventilation & Safety ($2,000–$5,000)[8]

- Commercial exhaust hood (7ft EconAir-style): $1,500–$2,500

- Fire suppression system (code-required): $800–$2,000

- Propane regulators and line systems (400,000 BTU+): $500–$1,500

Inadequate ventilation is one of the most common health department violations. Invest fully here—a failed exhaust system upgrade costs $1,500–$2,500 in downtime and re-inspection fees.

Electrical & Power ($1,500–$3,000)

- 30–50 amp electrical hookup: $500–$1,000 installation

- Generator (if mobile operation required): $1,500–$2,000

- LED lighting and safety markers: $300–$500

Mobile trailers operating at non-equipped locations (festivals, parking lots) require generators. Permanent lot installations can rely on site power, reducing costs.

The Hidden Costs Nobody Tells You About

Most guides jump from trailer price to profitability without addressing the financial landmines that drain capital during your first 12 months. These costs are one-time and recurring burdens that separate undercapitalized ventures from sustainable ones.

Initial Permits, Licenses & Inspections ($1,500–$5,000+)

Geographic variance here is brutal:

- Business license: $50–$500 (varies dramatically by city)

- Health department food service permit: $300–$1,500

- Vehicle registration and commercial tags: $200–$1,000

- Fire safety/propane inspections: $150–$500[14]

- Zoning/location approval: $100–$1,000 (if required)

To place this in context: Indianapolis averages $590 total fees, while Boston spikes to $17,066 annually. This isn’t just an outlier—major metropolitan areas (NYC, Los Angeles, Chicago) cluster in the $5,000–$10,000 range. Plan conservatively unless you’re operating in a verified low-regulation area.

Annual renewal fees (ongoing): $500–$2,000 per year to maintain operational status

Equipment Certification & Compliance ($500–$2,000)

NSF certification for commercial-grade equipment is mandatory in most jurisdictions. If you buy used equipment lacking certification, replacement costs become prohibitive. Third-party food safety inspections ($200–$500 typically) verify NSF compliance before health department inspection.

Branding, Graphics & Wrap ($2,000–$8,000)

Don’t underestimate this. Your trailer’s exterior is a 24/7 marketing billboard:

- Professional wrap design: $1,500–$4,000

- Signage and menu boards: $500–$2,000

Quality branding separates professional operations from amateur setups—directly affecting foot traffic and perceived value. Budget here impacts customer acquisition cost.

Insurance (Annual: $1,500–$3,500)

Food truck insurance breaks down into multiple components:

- General liability: $44–$200/month depending on location and coverage limits

- Product liability: $55–$150/month

- Commercial auto (if towing): $150–$300/month

- Equipment coverage: $100–$200/month

- Workers’ compensation (if employees): $80–$400/month depending on payroll

Bundled policies typically cost $3,000–$5,000 annually. California and New York premium significantly higher than Texas or Georgia due to litigation risk and regulatory environment.

First-Month Operating Inventory ($2,000–$5,000)[8]

- Initial food and supplies purchase: $1,200–$3,000

- Propane fill: $300–$500

- Cleaning and maintenance supplies: $200–$500

This isn’t optional you cannot operate without functioning inventory and fuel reserves.

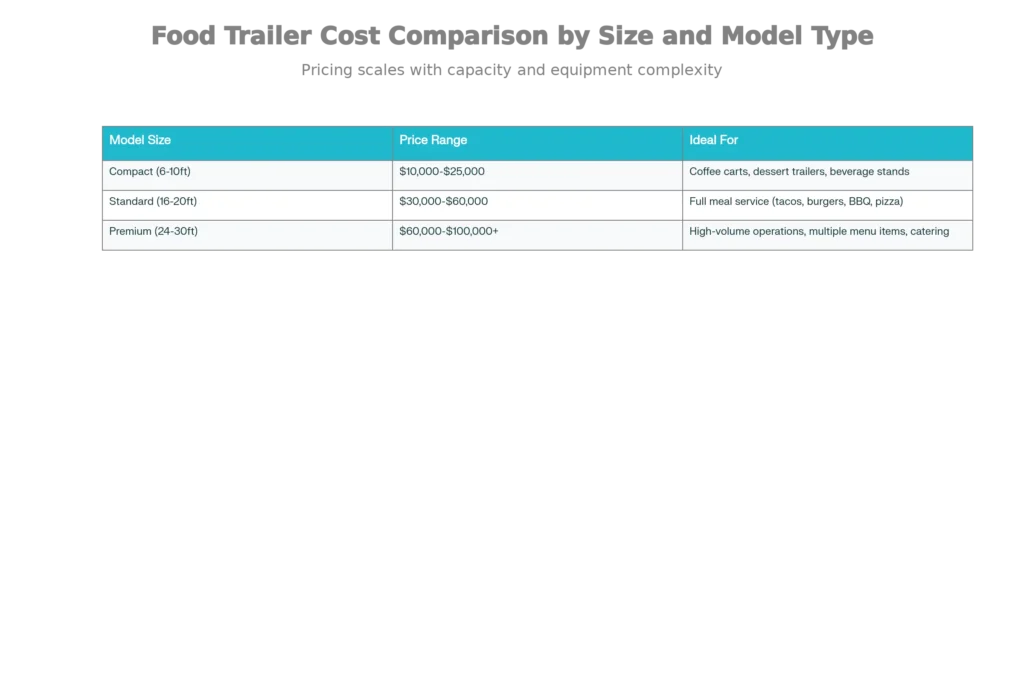

Food Trailer Cost by Size & Model Type

Matching your financial investment to concept and location is critical for ROI. There’s no universal right answer—only your specific market opportunity.

Compact Models (6–10ft trailers: $10,000–$25,000)

Ideal for: Coffee carts, dessert trailers, beverage stands

These minimal-footprint units have been the fastest-growing segment. They operate with basic counter space, limited cooking capacity (single griddle, small fryer), and roughly 60–80 square feet of interior space. Perfect for farmers markets, events, and locations where volume comes from high foot traffic and low individual transaction complexity.

What’s included: Counter service window, basic equipment package, portable operation capability

Best for: Part-time operations, catering as side income, event-based revenue (festivals, markets)

Standard Models (16–20ft trailers: $30,000–$60,000)

Ideal for: Full meal service (tacos, burgers, BBQ, pizza)

This is the sweet spot where most profitable food trucks operate. Complete kitchens with multiple cooking stations, dedicated prep areas, and ample refrigeration create workflow efficiency for 2–3 person teams. You can simultaneously cook, prep, and serve eliminating bottlenecks that kill profitability. Most established food truck parks demand this size minimum.

What’s included: Complete kitchen with 150–200 sq ft workspace, multiple equipment stations, generous storage, water/propane systems rated for sustained high-volume service

Best for: Food truck parks, street vending, events (high volume potential), first-serious-attempt entrepreneurs

Premium Models (24–30ft trailers: $60,000–$100,000+)

Ideal for: High-volume operations, multiple menu items, catering

These are essentially mobile restaurants. Dual cooking zones allow simultaneous operation, walk-in storage handles ingredient volume for 8-10 hour operating days, and specialized equipment (dual fryers, multiple ovens) supports diverse menu items. Catering operations particularly benefit from the 25–40 person seating capacity some builders integrate.[8]

What’s included: Dual cooking zones, walk-in storage, specialized equipment, commercial-grade capacity rated for 500+ covers/day potential[8]

Best for: Established businesses scaling up, catering-focused models, franchise operations

New vs. Used Food Trailers: The Direct Comparison

Decision-making clarity comes from honest comparison. Here’s the reality matrix that separates viable paths from financial traps:

Financing Options: How to Pay for Your Food Trailer

Capital constraints eliminate most aspiring food truck owners before they start. Financing removes this barrier—but only if you choose structures matching your business maturity.

Self-Financing (All Cash Payment)

If you have $40,000–$100,000 accessible, this is cleanest. No debt burden, full operational control, zero interest payments eating margin. Typical structure requires 60% deposit upon signing, 40% on delivery. Psychological advantage: cash buyers negotiate better prices and get priority production slots from fabricators.

Reality: Most founders lack this capital. And even those with reserves face opportunity-cost questions: Is the food truck your best investment versus stock market returns or business acquisition?

Business Loans & SBA Financing

SBA loans dominate the food truck lending space. Competitive rates (7–12% APR over 5–7 years) enable $25,000–$150,000 financing depending on business plan detail and personal credit score (680+ minimum). Tax-deductible interest preserves working capital that new operations desperately need.

Approval requires: Detailed business plan, personal guarantee (your home is collateral), 2 years tax returns or business plan projections, and credit report review. Timeline: 4–8 weeks from application to funding.

Equipment Financing & Lease-to-Own

Monthly payments: $800–$2,500 depending on trailer value

Lease duration: 24–60 months typical

Advantage: Fixed predictable costs, tax deductible as business expense

Risk: Total cost exceeds outright purchase by 15–25%. After 36-month term on a $50,000 trailer at $1,500/month, you’ve paid $54,000 in interest and fees alone.

Best for: Operators testing concepts before full capital commitment or those lacking down-payment reserves.

Vendor Financing (Direct from Manufacturers)

Many fabricators like Golden State Trailers offer proprietary payment plans with 0–4% APR for qualified buyers. Terms typically run 24–48 months. Advantage: Streamlined approval (no third-party bank scrutiny), often requires only credit check and down payment (20–30%).

Best for: First-time buyers with decent credit (650+) seeking speed and simplicity over rate optimization.

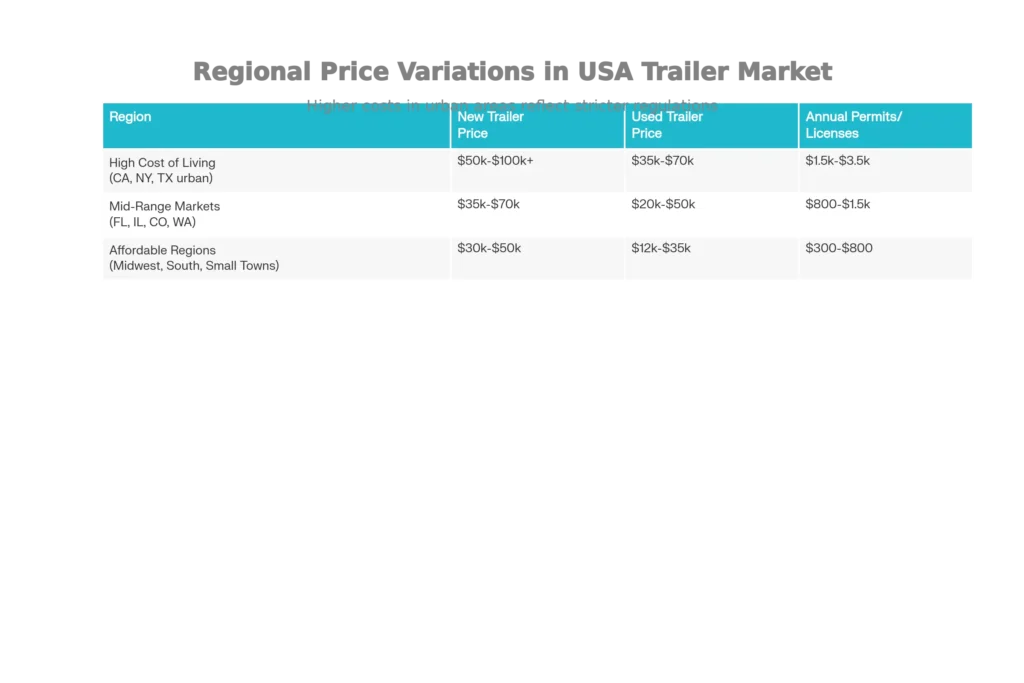

Regional Price Variations in the USA

Your location’s regulatory environment and labor costs create dramatic pricing swings. Here’s what expecting in different markets:

High Cost of Living Areas (California, New York, Texas urban)

New trailer: $50,000–$100,000+

Used trailer: $35,000–$70,000

Permits & licenses alone: $1,500–$3,500 annually

Reason: Stricter building codes, higher labor costs for fabrication, premium real estate parking fees, and aggressive food safety enforcement. California’s 6.5% sales tax on trailers adds $2,500–$6,500 depending on model. New York City’s Department of Health enforces NSF-compliance levels exceeding most states. Texas urban centers (Houston, Dallas, Austin) demand specialized propane safety certifications.

Mid-Range Markets (Florida, Illinois, Colorado, Washington)

New trailer: $35,000–$70,000

Used trailer: $20,000–$50,000

Permits & licenses: $800–$1,500 annually

Reason: Moderate code enforcement, competitive manufacturer presence, and established food truck markets create price pressure favoring buyers. Florida’s year-round weather reduces seasonal variability. Colorado’s altitude demands propane system adjustments (higher BTU requirements), adding $1,000–$2,000. Washington’s licensing is straightforward.

Affordable Regions (Midwest, South, Small Towns)

New trailer: $30,000–$50,000

Used trailer: $12,000–$35,000

Permits & licenses: $300–$800 annually

Reason: Lower cost of living reduces fabrication labor, less regulation means minimal compliance costs, and rural buyer’s markets favor negotiation. Iowa, Kansas, and Arkansas represent legitimately affordable entry points. Small towns often require only basic business license ($50–$200) plus health permit ($200–$400). Used trailers flood this market—less demand reduces values.

ROI Calculation: Breaking Even on Your Investment

Price doesn’t matter profitability does. Let’s reverse-engineer the numbers that separate success from failure.

Average Revenue & Margins

Daily revenue (established truck after 90 days): $800–$2,000 depending on location and concept

Average food cost %: 25–35% of revenue (tacos typically 28%, BBQ 32%, coffee 22%)

Daily gross profit: $520–$1,500

Operating costs (fuel, permit renewal pro-rata, staff): $100–$300/day

Daily net profit potential: $220–$1,200

Break-Even Timeline

Best case scenario: $40,000 investment ÷ $1,200 daily net profit = 33 days (if running daily at capacity)[8]

Average case: $60,000 investment ÷ $800 daily net profit = 75 days (realistic for most concepts)

Worst case: $80,000 investment ÷ $500 daily net profit = 160 days (slow start, unfavorable location, or poor concept-market fit)

Most established food trucks recover investment within 60–90 days of consistent operation. This assumes you’ve validated location viability and have operational discipline to hit daily revenue targets.

Year 1 Financial Projection

Total investment: $50,000–$100,000

Operating expenses (fuel, permits, insurance, payroll, commissary): $30,000–$60,000 annually

Revenue potential: $200,000–$400,000 annually (if operating 5–6 days/week, 250+ operating days/year)

Net profit Year 1: $50,000–$200,000 highly variable depending on food cost control, labor efficiency, and market conditions

Conservative first-year projection assumes 40% food costs, 15% labor (if solo-operated, this is $0), 20% operating expenses, yielding 25% net margin on top-line revenue. A $300,000 revenue trailer at 25% margin generates $75,000 profit exceeding your investment in year one if you can sustain volume.

The real risk: Falling below $500–$600 daily revenue after 120 days signals concept-market misalignment and requires immediate menu or location adjustment to avoid burnout.

Special Cases: Custom Concepts & Niche Pricing

Your specific concept drives equipment needs and costs vary dramatically.

Coffee/Espresso Trailers ($20,000–$40,000)

Compact footprint with specialized espresso machines ($4,000–$8,000), grinders ($1,500–$3,000), and refrigeration for milk/syrup storage. Lower equipment costs create higher margins specialty coffee commands $5–$7 per transaction versus tacos at $4–$6. High-traffic locations (downtown street corners, corporate parks) can generate $1,200–$1,800 daily revenue from 200–250 transactions.

BBQ/Smoker Trailers ($45,000–$80,000)

Commercial-grade smokers and grills add premium cost ($8,000–$15,000 for quality offset or reverse-flow smokers). Larger trailers required to house equipment plus 48-hour smoking inventory. These are typically destination concepts—customers seek them out based on reputation. Lower daily volume (150–250 covers) but much higher transaction values ($8–$15/plate) create profitability despite lower ticket count.

Dessert/Gelato Trailers ($25,000–$50,000)

Specialized refrigeration (blast freezers, gelato display cases) dominates budget: $6,000–$12,000 for commercial-grade equipment. Small footprint but equipment-intensive. High margins (gelato typically 60–70% profit margin after COGS). Seasonal variability requires additional capital reserves for off-season months.

Pizza/Wood-Fired Trailers ($50,000–$150,000+)

Custom-built wood-fired ovens command $5,000–$15,000 alone. Heavy-duty trailers with reinforced framing support the oven’s weight (3,000–5,000 lbs). Premium pricing justified by high transaction values ($6–$12 per slice, $18–$30 per whole pizza) and strong brand differentiation. These are the highest-revenue-potential concepts but also demand most customer acquisition effort.

Money-Saving Tips: How to Reduce Your Costs

Smart financial choices compound. Here’s exactly where to cut without sacrificing operational capability.

Buy Used Equipment & Reconditioned Appliances

Save 30–50% on individual equipment purchases by sourcing from catering equipment dealers and restaurant liquidation sales. A reconditioned $3,000 griddle becomes $1,500. Problem: Warranty typically non-existent. Solution: Negotiate 6-month return windows with dealers and perform functionality tests before installation.

Start Smaller, Scale Later

Begin with compact 14–16ft trailer ($20,000–$35,000) instead of 24ft premium build ($80,000+). Easier to operate solo, lower initial risk, reduced daily operating costs. Once you validate concept and hit consistent $1,000+/day revenue, upgrade to larger unit. This staged approach is psychologically advantageous—small wins build momentum and reduce decision paralysis.[8]

Negotiate with Fabricators

Custom builders often have flexibility on smaller margins. Bundle orders (multiple units) can reduce per-unit costs. Off-season purchases (winter months, January–March especially) yield discounts of 5–15% as fabricators seek cash flow during slow periods.

DIY What You Can (Responsibly)

Interior design, graphics, and social media branding are DIY-friendly and save $1,500–$3,000. Installation of critical equipment (plumbing, electrical, propane) should always hire professionals—mistakes create legal liability and health code violations. Food sourcing: Build supplier relationships early through networking in restaurant industry groups—better rates compound to 10–15% savings on COGS.

Explore Used Financing

Used food trailers often have lower financing rates (4–6% versus 8–12% for new) through SBA programs. SBA Microloan programs ($10,000–$50,000) specifically support startups with thinner credit profiles than traditional lenders require.

Red Flags: What NOT to Buy

Experienced operators spot disaster before contracts are signed. Here’s what to avoid:

Trailers with Structural Damage

Rust on suspension components, frame bending from collision impact, or water damage inside walls become $5,000–$15,000 repair projects. Always inspect underneath, not just exterior appearance. Test all operating systems (water pressure, propane flow, electrical outlets) before purchase. A structural inspection by third-party mechanic ($300–$500) pays for itself by avoiding hidden liability.

Non-Compliant or Undocumented Equipment

Unlicensed propane systems result in failed inspections and permit revocation. DIY electrical wiring creates fire hazard—insurance companies deny coverage for losses. Equipment without NSF certification delays health permits and can result in permit denial if local enforcement is aggressive. Never buy equipment without documentation proving compliance standards.

Unknown Ownership or Previous Violations

Check health department records for the seller’s previous violations. Linked violations (multiple failed inspections under prior ownership) indicate systemic design flaws inspection cannot surface. Unknown history equals unknown liabilities—resist the temptation to save $5,000 through purchasing from unknown individuals. Buy from established dealers with verifiable track records.

Too-Good-to-Be-True Pricing

Trailers priced 50%+ below market indicate something is wrong: salvage titles, rebuilt vehicles post-accident, or hidden structural damage. Rule of thumb: If price seems low, assume $5,000–$10,000 in hidden repairs once you own it.

Conclusion: Your Food Trailer Investment Decision

The food trailer market rewards clarity over guesswork. New trailers cost $40,000–$100,000+ but eliminate compliance risk and provide warranty protection on day one. Used trailers can be purchased for $10,000–$60,000 but demand professional inspection and budget $2,000–$10,000 for potential repairs.

Your location matters enormously. Boston-area operators budget $17,066 annually for permits alone; Midwest operators plan $300–$800. Regional cost differences can swing your break-even timeline by 30–60 days.

Equipment costs are non-negotiable plumbing, ventilation, and NSF-compliant refrigeration cannot be cut responsibly. However, cooking appliances offer flexibility: start with essential griddle and fryer, scale to multiple ovens and specialized equipment once revenue justifies.

Financing removes the $50,000+ capital barrier if business metrics support loan terms. SBA 7(a) loans (7–12% APR, 5–7 years) offer the best terms; vendor financing provides speed; lease-to-own works for concept testing.

Most food trucks recover investment within 60–90 days of consistent operation and achieve $50,000–$200,000 net profit in year one if you maintain food costs under 35%, control labor expenses, and hit daily revenue targets above $600. The real metric isn’t your trailer’s price it’s whether you can achieve $800–$1,200 daily revenue in your chosen location.

Now it’s your turn: Based on this financial framework, which combination of size, location, and financing structure aligns with your concept and capital availability? What’s the single biggest cost factor you need to research further before committing? Leave your analysis in a comment I’ll provide personalized insight on your specific situation.